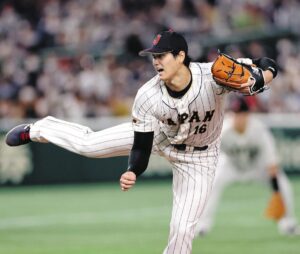

Shohei Ohtani’s outstanding performance in the major leagues has also attracted attention with his annual salary.

In particular, the 2024 season is a hot topic due to the salary and tax issues surrounding his historic 10-year, $700 million contract with the Dodgers.

This article provides detailed information about Ohtani’s salary structure and taxes, and also delves into his future prospects.

First, I will explain the background and details of how Ohtani’s 2024 salary was determined.

Next, we will explain the tax systems in the United States and California and clarify how much tax burden Ohtani is subject to.

We will also consider the impact that the deferred salary payment system will have on Ohtani and the team.

In addition, we will touch on Ohtani’s sponsorship income and future salary projections, and emphasize the importance of his financial strategy and health management.

Finally, we’ll take a closer look at his financial influence and contributions to the baseball world.

This will give us a fuller picture of Ohtani’s salary and taxes and provide some insight into his future prospects.

目次

- 1 Overview of Shohei Ohtani’s annual salary

- 2 Salary and tax system

- 3 2024 Tax Details

- 4 Impact of deferred payment of annual salary

- 5 Sponsorship income and taxes

- 6 Future salary forecast

- 7 Health Management and Financial Strategy

- 8 Shohei Ohtani’s influence and economic impact

- 9 Conclusion and future prospects

Overview of Shohei Ohtani’s annual salary

Shohei Ohtani’s salary has been attracting attention due to his outstanding performance and success in the major leagues.

Here, we will take a closer look at Ohtani’s Major League contract, the details of his salary in 2024, and his past salary trends.

Major League Contract

Shohei Ohtani made his major league debut in 2018, signing with the Los Angeles Angels.

His initial contract started with a relatively low annual salary, in accordance with rookie player regulations.

This is based on the Major League Baseball labor agreement, which stipulates that foreign players under the age of 25 are treated as “amateurs” and start their first year on a minor league contract.

After that, Otani’s performance with the Angels earned him salary arbitration rights and he signed a one-year contract worth $30 million in 2023.

This is the highest amount ever paid to a player with salary arbitration rights, demonstrating how high Ohtani’s performance and market value are.

In 2024, he signed a 10-year, $700 million contract with the Los Angeles Dodgers, the largest in North American professional sports history.

Salary details for 2024

Shohei Ohtani’s annual salary for 2024 is set at $2 million (approximately 290 million yen) as part of his contract with the Dodgers.

This amount is part of a total 10-year, $700 million contract, with the remainder to be paid in arrears.

One of the reasons why Ohtani chose this type of contract was to adjust his total annual salary in order to allocate funds to strengthening the team.

Ohtani’s contract keeps his 2024 salary relatively low with larger payments planned for the future.

However, the deal is set to significantly increase his earnings over the course of his career.

This is an example of a flexible contract structure that benefits both the player and the team.

Past annual salary trends

Shohei Ohtani’s annual salary has fluctuated greatly as his major league career has progressed.

When he made his debut in 2018, he signed a minor league contract with the lowest guaranteed annual salary. However, his subsequent performance has led to a steady increase in his annual salary.

Of particular note is his $30 million salary in 2023.

This was the first year that Ohtani was eligible for salary arbitration, resulting in a salary that properly reflected his market value.

In 2024, Ohtani signed a massive 10-year, $700 million contract with the Dodgers, taking his annual salary to even greater heights.

In this way, Shohei Ohtani’s annual salary reflects his performance and increasing market value.

His career is a good example of how players are valued in the major leagues, and we are looking forward to seeing him continue to do well in the future.

Salary and tax system

It is very important to understand how the US tax system and California’s tax rate affect Shohei Ohtani’s annual salary.

For a player with a high salary like him, the tax burden is a major issue.

Here we take a closer look at the US tax system, California tax rates, and overall tax burden.

American Tax System

In the United States, federal taxes are levied on income. Federal tax rates are progressive, meaning that the tax rate increases as your income increases.

As of 2024, federal income tax rates range from 10% to 37%, with the highest income brackets being taxed at 37%.

High-income earners like Shohei Ohtani will be subject to this highest tax rate.

The US tax system also includes Social Security and Medicare taxes.

Social Security tax is 6.2% of your salary, and Medicare tax is 1.45% of your salary, but there are certain income limits for these, and Social Security tax in particular has a cap.

On the other hand, there is no cap on Medicare taxes, and high-income earners are subject to an additional 0.9% Medicare surcharge.

California Tax Rates

California, home of Shohei Ohtani’s Los Angeles Dodgers, has one of the highest state income tax rates in the United States.

California state income tax is a progressive tax system with rates ranging from 1% to 13.3%.

The highest tax rate of 13.3% applies to high-income earners, so high-income earners like Ohtani will be subject to this tax rate.

Additionally, in California, there may be several local taxes in addition to state taxes, which can further increase your overall tax burden.

Overall tax burden

Shohei Ohtani’s overall tax burden is the sum of his federal and state taxes.

First, you’ll be subject to a 37% federal income tax, plus a 13.3% California income tax, plus Social Security tax, Medicare tax, and an additional Medicare surcharge.

Add these together and his tax burden on his annual income is very high.

For example, if your annual salary in 2024 is $2 million, you will be taxed about $740,000 in federal taxes alone and about $266,000 in state taxes.

When Social Security and Medicare taxes are added to this, the tax burden increases even further.

As such, the tax burden is extremely heavy for high-income earners like Shohei Ohtani.

However, this tax burden can be controlled to some extent by managing his income and by doing proper financial planning.

Working with his team, you will be able to develop an optimal financial strategy to maximize your benefits while minimizing your tax burden.

Overall, an understanding of the U.S. tax system, California’s tax rates and overall tax burden are essential components of managing Shohei Ohtani’s finances.

With this knowledge, you will need to devise a strategy regarding his salary and taxes.

2024 Tax Details

Let’s take a closer look at the tax burden on Shohei Ohtani’s 2024 salary.

His income is made up of federal, state and other taxes.

These taxes make up a large portion of Ohtani’s income, so it’s important to understand them accurately.

Federal Tax

In 2024, the United States federal income tax rate is based on a progressive tax system, with the top rate being 37%.

If Shohei Ohtani’s annual salary is $2 million (approximately 290 million yen), this highest tax rate will apply.

Calculating the exact tax amount, Ohtani will pay approximately $740,000 (approximately 107 million yen) in federal income tax.

Generally, federal tax is calculated as follows:

- Taxable income is calculated by subtracting various deductions from total income.

- Progressive tax rates are applied to taxable income.

- The resulting tax amount is then withheld as federal tax.

In Ohtani’s case, his high income will be subject to a 37% tax rate, meaning he will have to pay a significant amount of tax.

State Tax

California has one of the highest state income tax rates in the United States, with a top rate of 13.3%.

This tax rate is also based on a progressive tax system, with high-income earners like Shohei Ohtani being subject to this highest tax rate.

The state tax applicable to an annual salary of $2 million would be approximately $266,000 (approximately 38.7 million yen).

California state tax is calculated as follows:

- Taxable income is calculated by subtracting state-specific deductions from gross income.

- Progressive tax rates are applied to taxable income.

- The resulting tax amount is collected as state tax.

As such, California state taxes, like federal taxes, are based on a progressive tax system that places a heavy burden on high-income earners.

Other taxes

Shohei Ohtani’s income is subject to various taxes in addition to federal and state taxes.

The most important of these are Social Security and Medicare taxes.

-

Social Security Tax : This tax is 6.2% of your salary. However, as of 2024, there is a cap on the amount of income that is subject to Social Security tax, and no additional Social Security tax is levied on income above a certain amount.

-

Medicare Tax : 1.45% of your salary. In addition, high earners are subject to an additional 0.9% Medicare tax, for a total of 2.35% Medicare tax.

-

Local Taxes : Some locations may have additional local taxes, which vary by city and/or county, so the exact amount will depend on where you live.

For high-income earners like Ohtani, these taxes will further increase their overall tax burden.

When these taxes are taken into account against his income, the amount he actually has left over is significantly reduced.

Overall, Shohei Ohtani’s tax burden on his 2024 annual salary will be very high.

A variety of taxes affect his income, including federal, state, Social Security, Medicare and local taxes.

Taking all these factors into account, a large proportion of his total income will be paid as tax.

Impact of deferred payment of annual salary

Shohei Ohtani’s 2024 contract includes a deferred salary element.

There is a reason behind the contract and the benefits to the team and Ohtani himself.

Here we will explain in detail the background of the contract, its benefits to the team, and its benefits to Ohtani.

Background of the Agreement

Shohei Ohtani signed a massive 10-year, $700 million contract with the Los Angeles Dodgers, with about 97% of that amount being paid in deferred payments.

This type of contract is not uncommon in Major League Baseball and offers financial benefits to both player and team.

Deferred payment contracts are widely used as a way for teams to ease short-term financial burdens and for players to gain long-term financial stability.

The background to this contract is that the Dodgers aim to secure funds to strengthen the team while guaranteeing Ohtani high salaries in the future.

In addition, by securing a long-term income, Ohtani will be able to achieve financial stability after his career ends.

Benefits for your team

Deferred salary contracts offer several important benefits to teams.

First, it will reduce our short-term financial burden, freeing up the funds we need to acquire other players and strengthen our squad.

This will allow the Dodgers to maintain a competitive team and effectively execute their strategy to win championships.

Secondly, deferred salary payments also serve as a way to limit the impact of the luxury tax.

In Major League Baseball, a luxury tax is imposed when a team’s total annual salary exceeds a certain amount, but by signing a deferred salary contract, the total annual salary amount can be kept low, thereby reducing the luxury tax burden.

Additionally, deferred salary contracts are also a good way to demonstrate a long-term commitment to a player.

This will enable us to build trust with our players and maintain long-term partnerships.

Benefits for Ohtani

For Shohei Ohtani, there are several benefits to a contract that allows him to receive his salary in arrears.

First, it will ensure long-term financial stability: With a large portion of the 10-year contract paid in deferred payments, Ohtani will have a stable income even after his career ends.

This will ensure you have financial security after retirement.

Secondly, it is possible to smooth out the tax burden. By receiving a large annual salary in installments rather than all at once, you may be able to reduce your tax burden per year.

Deferred salary payments can be an effective strategy, especially for avoiding the higher tax rates that apply once your income exceeds a certain amount.

Furthermore, for Ohtani, a long-term contract would also lead to career stability.

His 10-year contract with the Dodgers ensures he will be a part of the team for the long term.

This will hopefully allow him to focus more on his game and perform at his best while minimising the risk of injury.

In this way, the deferred salary contract brings great benefits to both Shohei Ohtani and the Los Angeles Dodgers.

This is an effective way to balance a team’s financial strategy with the long-term stability of its players, and it is likely to be adopted by many teams and players in the future.

Sponsorship income and taxes

A large part of Shohei Ohtani’s income comes from sponsorship deals.

His influence and market value is so great that many companies have sponsorship deals with him.

Here we take a closer look at the sponsorship contract overview, income and tax burden, and the details of sponsorship income.

Summary of sponsorship agreement

Shohei Ohtani has signed numerous sponsorship contracts, and the value of his contracts is increasing every year.

Given his popularity and influence, sponsorship income is one of his main sources of income along with his annual salary.

His sponsorship contracts include with sporting goods manufacturers, beverage manufacturers, automobile manufacturers, and financial institutions, and these companies are using Ohtani’s brand image to conduct marketing activities.

These contracts are often renewed periodically based on his market value and performance, with successful seasons or special achievements resulting in increased contract amounts and new sponsorship deals.

This makes Ohtani’s sponsorship income very stable and contributes significantly to his overall income.

Income and tax burden

Sponsorship income is subject to tax like any other income.

In the United States, sponsorship income is generally treated as business income and is subject to federal and state taxes.

Federal tax rates are determined based on a progressive tax system, just like annual salary.

For high-income earners like Ohtani, the maximum tax rate of 37% often applies.

California state taxes also apply, with a maximum rate of 13.3%.

Additionally, sponsorship income is subject to Social Security and Medicare taxes, making the overall tax burden very high.

The specific tax burden on sponsorship income varies depending on the contract terms and the amount of income, but it represents a significant burden for high-income earners like Ohtani.

Sponsorship Revenue Details

Shohei Ohtani’s sponsorship income comes from a variety of contracts.

Major sponsors include sporting goods manufacturers such as Nike and Mizuno, beverage manufacturers such as Asahi Soft Drinks and Orion Beer, and automobile manufacturers such as Toyota and Lexus.

These contracts involve Ohtani’s participation in advertising and promotional activities, helping to promote the products through his brand image.

Details of sponsorship agreements may include a monetary amount as well as bonuses and incentives.

For example, additional compensation may be paid if Ohtani achieves certain accomplishments or participates in certain events.

This makes sponsorship revenue very flexible and diversified.

In addition, sponsorship agreements have set term limits and are subject to regular review and renewal.

A successful season or exceptional performance can bring increased contract amounts and new sponsorship deals.

As a result, Otani’s sponsorship income has remained stable but is on the rise.

Overall, the relationship between Shohei Ohtani’s sponsorship income and taxes is complicated, but by making the most of his market value and influence, sponsorship income has become his main source of income alongside his annual salary.

Managing these incomes appropriately and creating a tax-conscious financial strategy has contributed to his long-term success and stability.

Future salary forecast

Shohei Ohtani’s annual salary is expected to continue to increase as his performance and market value improves.

We’ll go into detail about his salary beyond 2025, contract options and variables, and his long-term earnings outlook.

Salary from 2025 onwards

After 2025, Shohei Ohtani’s annual salary will be determined based on his 10-year, $700 million contract with the Los Angeles Dodgers.

The majority of the contract is paid in deferred payments, so his annual salary will remain constant at $2 million from 2025 to 2032.

This will ensure Ohtani’s income is stable over the long term, providing great peace of mind for his financial planning.

This contract type is a very effective strategy for ensuring Ohtani a stable income even after retirement.

His annual salary will remain constant beyond 2025, making it easier for him to plan his finances during his playing career and ensuring financial stability for the future.

Contract Options and Variables

Shohei Ohtani’s contract includes an opt-out option under certain conditions.

For example, if the Dodgers’ owner or general manager of operations were to leave the team, Ohtani would be given the option to terminate his contract and sign a new one.

These contract options are in place to give players more flexibility and increased negotiating power in the future.

There is also a possibility that his contract may be reviewed and renewed as his performance and market value improves.

In particular, if he continues to perform well, he could potentially receive increased sponsorship income and bonuses, which could boost his total earnings.

This is expected to further stabilize and increase Ohtani’s long-term income.

Long-term revenue outlook

Shohei Ohtani’s long-term earnings outlook is very bright.

His salary will remain stable for the duration of his contract, and he is expected to receive income from sponsorships and other sources.

In particular, as his brand value grows, new sponsorship deals and promotional activities are expected to increase, significantly increasing his total income.

Additionally, Otani will be able to continue earning income through various activities even after his retirement.

You can have diverse sources of income, such as a career as a commentator or coach, or through business or charity work.

This will give him financial security even after retirement.

Additionally, as a long-term financial strategy, you could consider increasing your income through investments and asset management.

He can leverage his high income and make the right investments to further strengthen his future financial stability.

Overall, Shohei Ohtani’s future salary and earnings outlook is very bright.

With a stable annual salary, plus ample sponsorship and other income sources, they have a strategy in place to maintain financial security in retirement.

With his success and increasing market value, it is expected that he will continue to earn a high income in the future.

Health Management and Financial Strategy

Shohei Ohtani’s success depends not only on outstanding performance, but also on health management and financial strategy.

Let’s take a closer look at these factors that underpin his career.

The Importance of Health Management

Health management is extremely important for Ohtani as an athlete.

He needs to keep his strength and conditioning at an optimum level to maintain peak performance.

As part of his health management, Ohtani is taking the following measures:

-

Balanced diet : Otani strives to eat a nutritionally balanced diet. He repairs his muscles and replenishes his energy by consuming a well-balanced amount of protein, carbohydrates, vitamins, and minerals. The timing and content of his meals are also important, and he pays particular attention to them before and after games.

-

Proper sleep : Good quality sleep is essential for physical recovery and mental refreshment. Ohtani ensures at least eight hours of sleep every night, and uses blackout curtains and comfortable bedding to improve his sleep environment. Relaxation techniques and stress management are also important to improve the quality of his sleep.

-

Recovery and Training : After training, we use ice baths, massages and stretching to recover. This helps to minimize muscle fatigue and prepare for the next match or training. We also use scientific training methods to keep the players in the best condition.

Financial Planning and Investment

With such a high income, proper financial planning and investments are important for Shohei Ohtani. Let’s take a look at the financial strategies he has used to effectively manage his income and prepare for the future.

-

Income Management : Otani works with a professional financial advisor to manage his total income, including his salary and sponsorship income, so he can plan how he spends his income and avoid wasteful spending.

-

Diversified investment portfolio : In order to effectively manage our high income, we diversify our investments. We have built a diverse investment portfolio including stocks, real estate, and bonds to diversify risk. This allows us to maintain long-term financial stability while ensuring stable returns.

-

Tax Planning : With a high income comes a high tax burden. Otani has taken appropriate tax-saving measures to avoid paying taxes. He has adopted strategies to minimize his tax burden through a deferred salary contract and certain investments. By working with a professional tax accountant, he is able to navigate the complexities of tax laws and create optimal tax planning.

Preparing for the future

Shohei Ohtani is planning not only for his active career but also for his post-retirement life. He is taking the following steps to prepare for the future:

-

Post-retirement career plans : Otani plans to pursue a career in coaching or commentary after retirement, which would allow him to continue contributing to the baseball world while also ensuring a source of income.

-

Social Contribution Activities : He is also actively involved in charity work and community support, and it is expected that he will continue to have a wide-ranging impact by contributing to society through sports even after his retirement.

-

Ensuring financial stability : We plan and save and invest our current income to ensure a stable life after retirement. This will enable us to maintain a financially stable life even after retirement.

Overall, Shohei Ohtani’s success is closely linked to his health management and financial strategy.

Managing these factors effectively ensures he maintains high performance over the long term and is well-prepared for the future.

Shohei Ohtani’s influence and economic impact

Shohei Ohtani has had a major impact not only on the baseball world but also on the economy as a whole with his outstanding performance and two-way playing style.

Here we take a closer look at the impact on baseball, the economic impact, and the reaction of fans and the media.

Impact on baseball

Shohei Ohtani’s influence is bringing about major change throughout the baseball world.

His two-way play shows the potential of a player who can excel as both a pitcher and a batter, providing a new goal for many young players.

Ohtani’s success is also influencing baseball tactics and training methods, and will contribute to the future evolution of baseball.

His success also strengthened the relationship between Japanese baseball and Major League Baseball.

His success has paved the way for many Japanese players to play in the major leagues and has promoted international player exchanges.

It is hoped that this will further develop baseball as a global sport.

Economic impact

Shohei Ohtani’s influence is having a huge economic impact as well.

His presence is directly linked to the team’s revenue and sponsorship contracts, making him an important asset to the Los Angeles Dodgers, the team he plays for.

With many fans flocking to the stadium to watch him play, ticket sales and merchandise sales have increased significantly.

In addition, Ohtani’s sponsorship contracts are very expensive, and many companies are using his brand image for marketing activities.

Many major companies, including Nike, Mizuno, and Asahi Beverages, have signed contracts with him, which has increased their sales.

Ohtani’s economic impact extends beyond the baseball world to sports marketing as a whole, and his presence has a huge impact on the economy.

Fan and media reaction

Shohei Ohtani’s performance has received tremendous support from fans and the media.

His play and interviews during games always attract attention and he receives frequent media coverage.

In particular, his home runs and dominant pitching performances have excited fans and become a hot topic on social media and in the media.

Otani also values interactions with his fans and is proactive in providing fan service, such as signing autographs and taking photos after games.

This has made him more popular than ever, with many fans looking forward to seeing him play.

His achievements have been widely reported in Japan, and his matches attract large audiences.

Otani’s presence has also been widely covered in the media.

His performances and personality have been featured in many media outlets and his behaviour and playing style have been widely reported.

This has established Ohtani as an international sports icon, whose influence is likely to continue to grow.

Overall, Shohei Ohtani’s influence and economic impact is enormous, with far-reaching implications across baseball and the economy as a whole.

His existence shows new possibilities in the world of sports and gives dreams and hope to many people.

His work will continue to attract attention, and his influence is sure to grow even more.

Conclusion and future prospects

Shohei Ohtani is a player with outstanding performance and influence in the Major Leagues, and expectations are high for his continued success.

We take a closer look at his future prospects, salary and tax balance, and long-term career plans.

Otani’s future outlook

Shohei Ohtani’s future is very bright.

He has already set numerous records in the major leagues and is expected to continue to improve his performance.

In particular, his two-way playing style sets him apart from other players and is setting new standards across the major leagues.

His success is likely to continue beyond 2024.

He is expected to continue playing for the Dodgers under his current contract, but his market value will continue to rise.

Depending on his performance, new contracts and increased sponsorship deals are also expected.

Furthermore, his influence will continue to grow not just in baseball but in sports as a whole.

Salary and tax balance

The balance between Shohei Ohtani’s annual salary and taxes is very important in his financial planning.

His annual salary is high, but so is the tax burden that comes with it.

Federal taxes in the United States and state taxes in California are very high, and a significant portion of his total income goes to taxes.

Ohtani is using a deferred salary contract to smooth out his tax burden.

This allows us to reduce our annual tax burden while ensuring long-term financial stability.

We also work with professional tax accountants to create optimal tax plans, helping you navigate through complex tax laws and implement tax-saving measures.

This makes his financial strategy very solid and maintains his long-term financial stability.

Long-term career plans

Shohei Ohtani’s long-term career plans include not only his active career but also his life after retirement.

While his goal is to continue performing at his best while he’s still playing, he also has his sights set on a post-retirement career.

Possible career plans for him after retirement include coaching or commentating.

This will allow us to continue contributing to the baseball community while also ensuring a source of income.

He is also actively involved in social contribution and charity work, and aims to continue to have an impact on society through these activities even after his retirement.

Moreover, he is systematically saving and investing his current income to ensure financial stability.

This will help you maintain financial stability even after retirement.

With the right investment strategy, you can expect to secure future streams of income and achieve your long-term financial goals.

Overall, Shohei Ohtani’s future looks very bright, and his success will continue to have a major impact on baseball and the economy as a whole.

His financial strategy, which takes into account the balance of his annual salary and taxes, and his long-term career plan, will ensure he lives a stable life after retirement.

His success has given hope and dreams to many people, and they look forward to his continued success.